The 9-Second Trick For Hsmb Advisory Llc

The 9-Second Trick For Hsmb Advisory Llc

Blog Article

Indicators on Hsmb Advisory Llc You Need To Know

Table of ContentsSome Ideas on Hsmb Advisory Llc You Need To KnowSome Of Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Mean?Some Known Facts About Hsmb Advisory Llc.Excitement About Hsmb Advisory LlcUnknown Facts About Hsmb Advisory Llc

Ford states to avoid "cash value or permanent" life insurance coverage, which is more of a financial investment than an insurance coverage. "Those are really complicated, featured high payments, and 9 out of 10 people don't require them. They're oversold since insurance representatives make the largest commissions on these," he claims.

Impairment insurance policy can be expensive. And for those that select long-term care insurance coverage, this policy might make disability insurance policy unneeded. Learn more about lasting care insurance policy and whether it's ideal for you in the next area. Long-lasting care insurance policy can aid spend for costs related to long-term care as we age.

Some Known Incorrect Statements About Hsmb Advisory Llc

If you have a chronic health issue, this type of insurance policy might finish up being important (Life Insurance). Nonetheless, do not let it worry you or your checking account early in lifeit's usually best to get a plan in your 50s or 60s with the expectancy that you won't be utilizing it up until your 70s or later.

If you're a small-business owner, think about securing your livelihood by buying business insurance. In the event of a disaster-related closure or duration of rebuilding, organization insurance can cover your revenue loss. Think about if a considerable weather condition event affected your shop or manufacturing facilityhow would certainly that affect your income?

Plus, making use of insurance could in some cases set you back greater than it conserves over time. For example, if you obtain a contribute your windshield, you might consider covering the repair work expense with your emergency cost savings rather of your vehicle insurance policy. Why? Because utilizing your automobile insurance policy can trigger your month-to-month premium to increase.

Indicators on Hsmb Advisory Llc You Should Know

Share these suggestions to shield liked ones from being both underinsured and overinsuredand talk to a trusted specialist when needed. (http://tupalo.com/en/users/6280892)

Insurance that is acquired by an individual for single-person protection or protection of a family members. The specific pays the premium, instead of employer-based wellness insurance coverage where the employer often pays a share of the costs. Individuals might buy and purchase insurance coverage from any kind of plans offered in the individual's geographical region.

Individuals and families may certify for economic aid to decrease the expense of insurance costs and out-of-pocket expenses, yet just when registering through Link for Health Colorado. If you experience certain modifications in your life,, you are eligible for a 60-day period of time where you can sign up in a specific plan, even if it is outside of the yearly open registration period of Nov.

15.

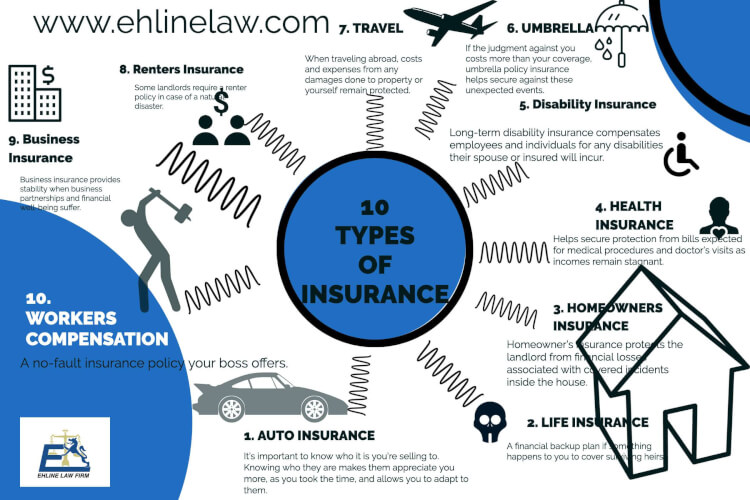

It may appear straightforward but understanding insurance coverage types can also be confusing. Much of this complication originates from the insurance coverage market's continuous goal to make personalized protection for insurance policy holders. In designing versatile policies, there are a variety to choose fromand all of those insurance coverage types can make it tough to comprehend what a certain plan is and does.

An Unbiased View of Hsmb Advisory Llc

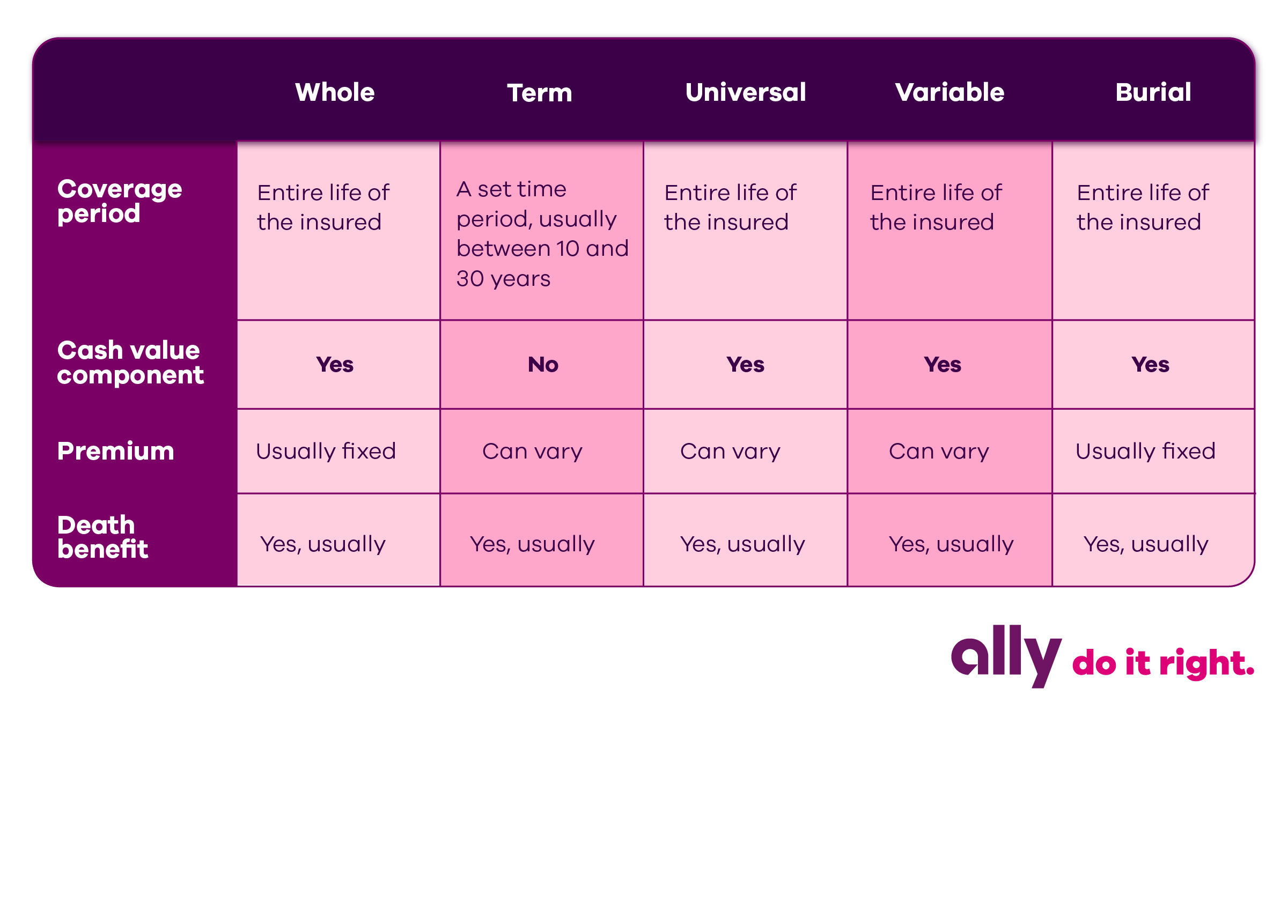

The very best location to begin is to chat concerning the distinction between both kinds of fundamental life insurance policy: term life insurance policy and permanent life insurance. Term life insurance policy is life insurance policy that is just energetic for a while duration. If you die during this duration, the person or people you've called as beneficiaries may obtain the cash payment of the plan.

However, many term life insurance policy policies allow you convert them to an entire life insurance policy plan, so you do not lose insurance coverage. Usually, term life insurance plan costs settlements (what you pay per month or year into your policy) are not secured at the time of purchase, so every 5 or 10 years you have discover this info here the policy, your premiums might rise.

They likewise often tend to be less costly total than whole life, unless you buy a whole life insurance coverage policy when you're young. There are likewise a few variations on term life insurance policy. One, called group term life insurance policy, prevails among insurance coverage choices you might have accessibility to with your employer.

Not known Facts About Hsmb Advisory Llc

Another variant that you may have accessibility to through your company is supplementary life insurance policy., or interment insuranceadditional coverage that can assist your family in situation something unforeseen happens to you.

Permanent life insurance policy merely refers to any kind of life insurance coverage plan that does not end.

Report this page